On the 3rd of February 1913, the sixteenth amendment was ratified, thus creating federal income tax.

This new amendment allows the Congress to levy an income tax without a devised or described plan among the states or basing it on Census results. That is to say, it matters little on circumstances of the states population or earning potential based on various industry etc. Therefore across the board all Americans were now, as of yesterday 1913, possibly accountable for income tax.

While today we are all, despite our earnings, required to pay income tax, that was not the case initially. As of yesterday in 1913 the new law would put that the incomes of couples exceeding $4,000, as well as those of single persons earning $3,000 or more, were subject to a one percent federal tax.Further, the measure provided a progressive tax structure, meaning that high income earners were required to pay at higher rates. What is interesting is that today with inflation that would mean only any couple earning over $93,023.26 would be taxed and they would only be taxed 1%. That is much different from today.

In fact, during all the discussion of the ‘Fiscal Cliff’ very was little said about the actual tax hike that they did allow to go through. As of right now anyone in the USA earning 0$ UP TO $120000 now have an increased 2.3%. This is simply a return to the amount from pre 2010. They then imposed that lowered 2% then to aid in the Recession and now it has been reinstated. Of course money now is worth less due to inflation and food and fuel costs have increased since then. That hardly seems fair. But, we are beginning to see some of the formulation of our modern world happening here in 1913.

The idea of income tax had happened previously in US history. During the Civil War we had to raise revenue to fund it so Congress introduced the income tax through the Revenue Act of 1861.

“It levied a flat tax of 3% on annual income above $800, which was equivalent to $20,693 in today's money. This act was replaced the following year with the Revenue Act of 1862, which levied a graduated tax of 3–5% on income above $600 (worth $13,968 today) and specified a termination of income taxation in 1866.”

Taxes were discussed and voted on continually after this point. And it wasn’t until After the Pollock v. Farmers' Loan & Trust Company of 1895:

“was a landmark case in which the Supreme Court of the United States ruled that the unapportioned (meaning not planned out or easily detailed plan of) income taxes on interest, dividends and rents imposed by the Income Tax Act of 1894 were, in effect, direct taxes, and were unconstitutional because they violated the provision that direct taxes be apportioned. The decision was superseded in 1913 by the Sixteenth Amendment to the United States Constitution.”

Therefore after this law it was now ‘legal’ to begin to tax income despite its definition being unconstitutional.

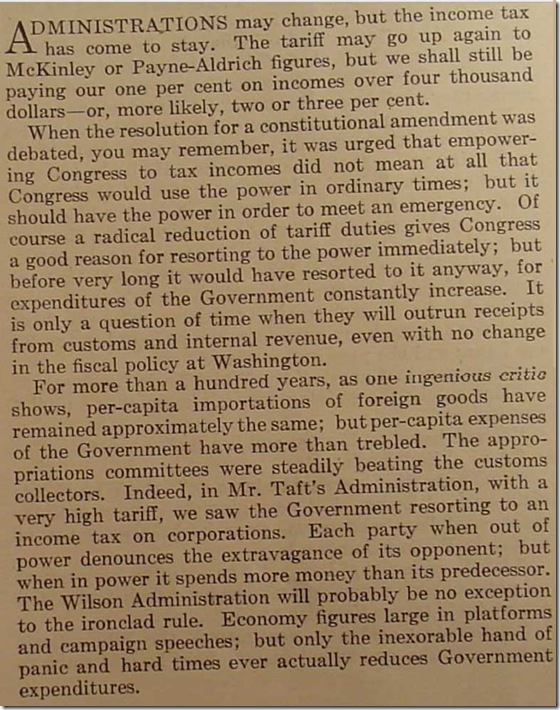

Here we see a cartoon of the 1870’s showing the general opinion of income tax.

By the 1930’s Roosevelt had signed the Social Security Act of 1935 into law. Prior to this less than 3% of the people in America paid income tax. So at this point in 1913 the 16th amendment doesn’t tax the wages of working class people. The tax then added another 1% of wages in tax for social security 1937. Today it is not uncommon to see wage taxation and garnishment take 65% or more of a worker's labor from him particularly with the new tax hike on the lower income workers as of 1 January 2013.

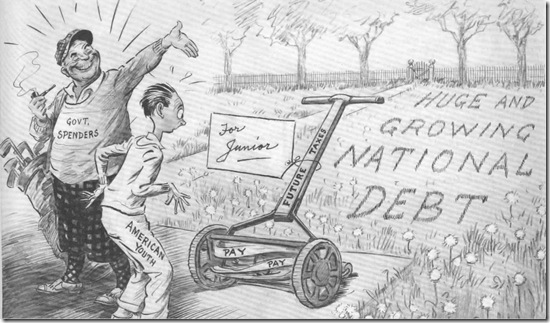

This cartoon from that same year shows Roosevelt’s plan. Doesn’t this seem like a familiar idea? Kicking the can down the road and increasing tax burden for the next generation. Certainly, my generation pays far more in tax than that of my parents as did they of theirs. I have to say I truly feel for the current generations.

As I am working part-time at a local cafe I work with some young people in their early 20’s and they speak of their future in a very dim way. They all live at home with parents, have no plan for college and often have an expensive i-Phone with a huge monthly bill but no car. These people live pay check to pay check and now they have just been given another 2% increase in their Federal Income tax, in addition to my state of MA is now considering lowering the sales tax but increasing the State income tax another 2%. That to me seems to be the opposite of helping an economy and providing less liquidity to put back into it (or into savings for that matter which currently rests at 9%)

And now we can see that by 1944 you must pay income tax if your income is over $500 which in today’s money would be $6,493.51. The working class and lower middle class are getting hit now as well.

Here are the new tax rates for 2013 which will add an additional 2.5% take out of our income at the Federal Level.

There were many in office who were against income tax. In 1910,

New York Governor Charles Evans Hughes, shortly before becoming a Supreme Court Justice, spoke out against the income tax amendment. While he supported the idea of a federal income tax, Hughes believed the words "from whatever source derived" in the proposed amendment implied that the federal government would have the power to tax state and municipal bonds. He believed this would excessively centralize governmental power and "would make it impossible for the state to keep any property"

In many ways this has become true. With our current economy when various State government or private corp/bus/institutions fail, they are bailed out and then owned by the federal government. This is rather unlucky as the main purpose of separate state powers is to not allow a central government to become too powerful, but I fear we are well beyond that.

I see that this year will have many little pot holes and realizations. Innocently choosing 100 years from this year to look at history seems to simply point out that the layers of our modern system run deeper than I imagined.

I am personally affected by the new income tax laws, as are anyone who works a simple job for little pay. I am also increasingly worried on my weekly trips to the market or the gas pump. The average pay for basic workers has not kept up with inflation for many years and it seems to continue to lag. I remember when I first discovered in 1955 that the then minimum wage was raised to $1 and with inflation in the year I was doing 1955 (2009) made that out to be $7 an hour. I was shocked to receive letters from followers than saying that their own states then, in 2009, did not even have a minimum wage of $7.

So, out of curiosity, I checked my inflation calculator today, in 2013 only five years from my original project and see now that $1 in 1955 would be $8.55 today! I know that is not the minimum wage in many states and I know the minimum wage in my own state has NOT gone up since 2008 and therefore people are earning less than a teenage grocery bagger in 1955 to start some jobs.

I do promise to try and follow such posts with happier posts about the home and recipes but I think it would be a mistake indeed if any homemaker were blind to the changes in our world. To have a blind eye on things that affect our world certainly is being lax in one’s home. The management of the home is an important job and requires not only skills in cooking, sewing, cleaning, childcare, but also the knowledge and know how of money management. And to therefore realize what money we are allowed to keep and to what extent we will continually be put upon to help support a somewhat failing system is of tantamount importance. We must, as homemakers, expect and demand the sort of frugality and honesty in our government money systems as we expect in our home.

My fear and concerns are, of course, that we have gone too far down the path. There may be no tuning back or change as we either have gone to far or are simply too easily controlled by media and technology that is sadly controlled by a few who also control production. food production, military, and in turn the government and banks. What is a homemaker to do?

I am certainly open for suggestions and more tips on stretching that dollar will of course be helpful but what if that dollar, itself, becomes so inflated that it has more value in burning it for cheap fuel? This has happened in the past and I surely hope won’t be in our future.

I hope all have a lovely day and I do hope all of you can keep a bright smile and happy countenance but also a wise ear and open mind to the changing world. It is a homemaker’s duty, as well, to not take what we see and hear on the news and papers at face value. Many a homemaker is also a mother and she can often ‘spot a rat’ when she sees Johnny looking innocent eyed up at her with the remains of a broken cookie jar/ biscuit tin at his feet. We must use such powers of deduction when viewing our world. It seems what we are told today and what is the reality often differ greatly.

Happy Homemaking to all.

I love your post. Thank you for writing this out. I don't think most people realize the reality of our money system. I didn't myself until I took an economics class in college and the Federal Reserve and banking system just didn't seem "right." Of course, if you say this, you become one of those crazy conspiracy theorists. Anyway, I'm all for self-reliance and learning the "basics." (should it come to that)

ReplyDeleteI think if you are productive and a creator, you give yourself value that no dollar can replace.

Thank you for your hard work in sharing this information. Have a lovely day!

ReplyDeleteI appreciate your research on this matter and it is vital to anyone who is trying to make sure they have money put aside and stretching a dollar.

ReplyDeleteYou have to be realistic and that is what you are doing and sharing with all of us. As my mother once said, "People who watch "Leave it to Beaver" and think life in the 50's did not have dark sides is an idiot." What she meant was do not take things at face value, which you are saying in this post as well. We would be fools to ignore what is happening with the economy. We are responsible for keeping the budget and making meals that go far for leftovers and another dinner or two. Prices will go up and so we need to be wise. I think it comes down to figuring our what to have on hand "just in case". Do we buy powdered milk to use in baking instead of regular milk? My husband recently bought me some dried coconut milk which I use in my baking a lot of the time and is cheaper than the cans. When I do not have eggs I use ground flax seeds in place of the eggs. I have also turned to using coconut oil instead of canola oil and sometimes in place of butter. Trader Joe's sells it at an excellent price. It is also a wonderful moisturizer for your face and body! These are little things I keep in our pantry to make sure I have something as back up in case I run out of the original ingredients. So, if I run out of eggs, at least I can still bake. :)