Today we are going to continue on with the Lesson’s from the 1950’s. I hope all understand that I do not mean to sound glib or pedantic or even preachy. I also know that complex problems of today aren’t easily solved. But, I also know that there is much to be said of common sense. And during the post war decade of the 1950’s we had the propaganda of public schools, TV, and increased print ads to help convey messages. And for the most part, the message of the day was use common sense, think before you act, and these are some basic rules that we, as human beings, can use to all get along and to try to make a better future.

Today we are going to continue on with the Lesson’s from the 1950’s. I hope all understand that I do not mean to sound glib or pedantic or even preachy. I also know that complex problems of today aren’t easily solved. But, I also know that there is much to be said of common sense. And during the post war decade of the 1950’s we had the propaganda of public schools, TV, and increased print ads to help convey messages. And for the most part, the message of the day was use common sense, think before you act, and these are some basic rules that we, as human beings, can use to all get along and to try to make a better future. A penny saved is a penny earned:This one is very easy and quite true. Yet, never before have we as a nation been less savers. And in no way do modern schools teach or prepare youngsters to make savings a part of their earning life. Money is meant to be spent and to do so the duty of a citizen to the almighty Economy, which seems to have a life of its own outside any benefit to the human population. We are meant to always be weary of it, to coddle it and to worry over its welfare without any real understanding over what an economy is or how it is meant to serve the population at large.

I think a good example of this is the rate of savings compared from 1950 to today. The personal savings rate in 1950 was about 10% while today it is merely between 2 to 3.7%. Here is the definition of ‘savings rate’:

Definition of 'Savings Rate'

The amount of money, expressed as a percentage or ratio, that one deducts from his/her disposable personal income to set aside as a nest egg or for retirement. The cash accumulated is typically put into very low-risk investments (depending on various factors such as expected time until retirement), like a money market fund or a personal IRA comprised of non-aggressive mutual funds, stocks and bonds.

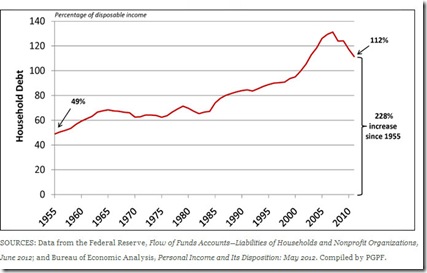

Par for the course with savings comes debt. Here we see in this chart the climb of household debt since 1955.

“Since the 1980s, household debt has steadily grown—it grew from 65 percent of disposable income to 112 percent in 2011. With easy access to credit, lax mortgage policies, and rising college costs, debt has become a norm in American households. Americans now own over 1 billion credit cards.”A large contributor to loss of savings and increase of debt is our old friend the credit card. And though hotel chains and oil companies had forms of credit cards as far back as the 1890’s, the modern credit card did really exist until the Diners Card. Though in 1946 John Biggins of the Flatbush National Bank of Brooklyn in New York the first bank issued credit card was invented. This was a "Charge-It" program between bank customers and local merchants. Merchants could deposit sales slips into the bank and the bank billed the customer who used the card.

The Diners Club card worked as follows:

“In 1950, the Diners Club issued their credit card in the United States. The Diners Club credit card was invented by Diners' Club founder Frank McNamara and it was intended to pay restaurant bills. A customer could eat without cash at any restaurant that would accept Diners' Club credit cards. Diners' Club would pay the restaurant and the credit card holder would repay Diners' Club. The Diners Club card was at first technically a charge card rather than a credit card since the customer had to repay the entire amount when billed by Diners Club.In the 1970’s the U.S. Congress actually passed a law against credit cards being sent to or applications for those who had not requested them Yet by 1996, the U.S. Supreme Court in Smiley vs. Citibank lifted restrictions on the amount of late penalty fees a credit card company could charge. Deregulation has also allowed very high interest rates to be charged.

American Express issued their first credit card in 1958. Bank of America issued the BankAmericard (now Visa) bank credit card later in 1958.”

This is a great chart showing information before and after the ‘Credit Revolution”. You can click to enlarge it.

There are endless examples of how the 1950 individual would differ greatly from today in terms of savings and even views on spending and the value of products. I often wonder what a 1955 homemaker would think if she were transported here and offered a double latte for $5. However, if you adjusted for the price of inflation so that they would see it in terms of their money, it would be around .85 cents while a cup of coffee in 1955 was around .35 cents. The price might not seem that greatly vast, but the idea of spending extra for coffee and far too much of the stuff with so much in the glass would just seem spendthrift and wasteful.

So, we have to really see that it is our own perception of value of object over the idea of saving that has also changed. Along with the endless list of products we now have and the ever more increased means of advertising them to us, we have also been advertised the way in which we view objects and things over savings. The very concept of want and need are blurred and to face days in which we do not spend is almost unfathomable for modern man. It is when we begin to see this very concept of perception that we can understand how much this, as well as generally less money around and more things to pay for, that affects our spending. But spending could still happen and be a higher percentage of the average person, but the concept and perception of it is hard to find in the modern world.

I know I have shared this film before but felt it needed to go here. Learn from this 1948 film “Your Thrift Habits”

Wash your hands before dinner.

I believe this simply little lesson is often ignored today. I am often amazed, when at friends or even at my little part time job that deals with food, how rarely people feel the need to wash their hands before they eat or after.I have been at friends houses and even said, I will just wash up before we sit down and have got stares. My hubby and I always wash up before any meal. And even as I have been preparing food and washing my hands along the way, I still take that last trip to the powder room to give the hands a good soap and water before I sit down to eat.

I wonder, sometimes, if the current fear of germs and the obvious increase in colds has anything to do with this. There are countless anti-bacterial stations at grocery stores, banks and in ladies handbags, but what happened to soap and water? I see children at my job come in for a snack with mother, fall upon the floor, drag their hands all along the walls and various surfaces, then sit down and begin eating a muffin or treat with their hands, never once heading to the lav to wash up. The same with the parents. Is this just my old fashioned hubby and me? Or my overly ‘proper’ family, or is it the norm today for people to not do this.

When one considers the myriad levels of cleaning products, sanitizers and constant fear of disease and spreading of germs, many people have no real idea of how germs are spread.

I wonder, too, if the common use of tissue/Kleenex contributes to the spread of germs? Once upon a time, and I have written of this before, we used handkerchiefs. Cloth that could be washed and disinfected, but only had your germs and was in your pocket/pocket book. It didn’t get smeared with your germs and then tossed into an open bin/garbage can. It didn’t get dropped in busy malls on floors or piled high in public restrooms. The idea to modern people of a used hankie with their own germs in their pocket repels yet a public space littered with everyone other person's germs upon bits of paper seems to not worry at all. And the counter to this same issue seems to be the over use of antibacterial and antibiotics rather than letting individuals build up healthy immunities on their own. We do need exposure to such things to build up the immunity in our own systems, but today we seem to do it the opposite way.

Let’s watch this short film about cleanliness, shall we. In this educational film, you will notice at the beginning that they do comment on disposable tissues for the sick boy in bed, but I believe that was just the modern convenience for the ill child and mother’s frequent need to disinfect the patience things. I am sure that healthy sister had her cloth hanky at hand.

So, there are three more lessons from 1950 that I thought were relevant to today’s living. And really important yet simple changes one could make to a modern life. In many ways we can face every day as a time traveler if we look to the past. We have the experience of our own past upon which to look and judge and see what worked and didn’t. And then we can act on today, as if we have received a message from our future self, to better work towards a better outcome for what we hope or aim for. I may include a few more of these old lessons in my next post, if these are still of interest to any of you.

I hope all have a lovely day and as always, Happy Homemaking.

Back in the 1960s (not quite your decade but almost) I remember commercial jingles for Household Finance: "Never borrow money needlessly, but when you need to borrow, trust HFC." That idea seems anachronistic today.

ReplyDeleteYour post (which I loved, by the way) also made me think of house sizes, and what would the 1950s person think of today's houses. Do we really need that much space?

Oh, and did I say I loved your post? Susan

Susan, I am glad you enjoyed it.

ReplyDeleteConcerning house sizes I have discussed this before and actually if you go to the box below this post you will see the "History" box today links to that article I wrote about house size and number of bathrooms from 1950's to today. Check it out if you get a chance.

I must admit to not being a hand washer before meals. My parents didn't raise us that way. But, considering that I'm the one making the meals, I'm always washing my hands throughout preparation, so I guess I essentially do wash my hands before eating after all. :)

ReplyDeletePL